Most of the cars registered in Brazil, the 7th biggest car market in the world, are produced in the country because taxes of up to 35% impact imported vehicles which only represent around 6% of registrations (mainly luxury brands). And also when we look at the financing side we see that Brazil is a market where domestic finance and lease companies are more important and bigger than the international ones, writes Pascal Serres, Chairman of the LatAm Advisory Board.

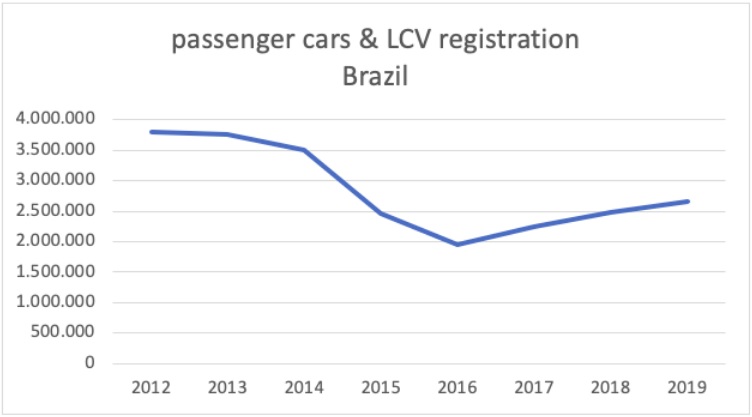

But why is that? 15% of the local production is exported (a large portion to Argentina). Registrations have been growing regularly from 2016. In 2019, new registrations rose 7.7% percent to 2.66 million whereas the global market and the Latin American market were shrinking.

In January 2020, car registrations were down 3% compared to last year and slow growth is expected for the year.

Fiat, Chevrolet and Volkswagen continue to lead the market and have increased their market share to represent 52% all together. Also worth mentioning is the dominant position of Fiat with 41% share of LCV. (67% for FCA, GM and VW on LCV).

Passenger car and LCV registrations in Brazil

| 2018 | 2019 | Growth | |||

| Registration | Market Share | Registration | Market Share | ||

| FCA | 496,080 | 18.61% | 433,110 | 17.50% | 14.54% |

| GM | 475,747 | 17.85% | 434,420 | 17.55% | 9.51% |

| VW | 411,005 | 15.42% | 366,912 | 14.82% | 12.02% |

| Renault | 293,150 | 8.97% | 214,814 | 8.68% | 11.33% |

| Ford | 218,601 | 8.20% | 226,521 | 9.15% | -3.50% |

| Toyota | 216,899 | 8.14% | 200,920 | 8.12% | 7.95% |

| Hyundai | 193,956 | 7.28% | 186,655 | 7.54% | 3.91% |

| Honda | 129,130 | 4.84% | 131,601 | 5.32% | -1.88% |

| Nissan | 96,088 | 3.60% | 97,515 | 3.94% | -1.46% |

| PSA | 47,781 | 1.79% | 44,008 | 1.78% | 8.57% |

| Others | 141,146 | 5.30% | 138,873 | 5.61% | 1.64% |

| Total | 2,665,583 | 100.00% | 2,475,349 | 100.00% | 7.69% |

Source: Associação Nacional dos Fabricantes de Veículos Automotores (ANFAVEA)

In 2017, vehicle registration data specialist Dataforce made a presentation at the Fleet Europe Summit in Estoril, indicating that corporate sales represented 30% of all sales in 2016 (which is the highest share in Latin America – average 20%). This percentage has likely increased but we do not have recent estimations. We can, nevertheless, assume that the corporate market now represents at least around 800,000 units (cars and LCVs) in 2019. Another interesting observation of Dataforce at that time was the overrepresentation of small cars (42%) if compared to Europe (19%) and LCVs (21% against 13% in Europe), which is understandable.

Our own recent surveys with Fleet LatAm indicate a robust growth of major leasing companies’ portfolios which I have estimated at a minimum rate of 15% in 2019. All together major leasing companies have been financing more than 160,000 cars, or around 20% of corporate registrations in 2019. This is a good performance but at the same time it indicates large possibilities for further improvement as both corporate sales share and fleet management share must certainly grow quickly again in 2020 and subsequent years. New mobility schemes and the switch from ownership to usage is happening everywhere.

Leaseco portfolios

| 2018 | 2019 | Growth | |

| Unidas | 72,000 | 85,000 | 18.06% |

| Localiza | 48,056 | 67,589 | 40.65% |

| Movida | 37,000 | ||

| ALD | 26,300 | 32,000 | 21.67% |

| LM Frotas | 23,000 | ||

| Arval | 24,000 | 22,500 | -6.25% |

| Ouro Verde | 20,000 | 22,000 | 10.00% |

| LeasePlan | 10,230 | 13,300 | 30.35% |

| Lets | 6,500 | ||

| Rodobens | 3,000 | ||

| VWFS | 1,211 | 1,500 | 23.86% |

| Total | 218,770 | 313,389 | |

| Estimated market growth | 14.62% | ||

| New business 2019 | 167,542 |

Sources: Fleet LatAm surveys and author

The first three and in particular the first two (Unidas and Localiza), which are much bigger than all others, are Brazilian companies (family-owned in the case of Localiza) and in both cases they are also very strong operators in the daily rental business. Each of them has more than 200,000 cars combining the two businesses. They have an impressive bargaining power to buy cars and enjoy competitive conditions from OEMs. They also demonstrate appetite for local customers and SMEs when international leaders like ALD, Arval and LeasePlan concentrate exclusively on fleet management and very big customers, international corporations and major Brazilian companies.

Two different business models are competing:

- Local heroes like Localiza and Unidas are combining fleet management with daily rental success, focusing on local customers (comparable to the Sixt model in Germany)

- International lessors like ALD, Arval and LeasePlan concentrate on international customers and lease and fleet management only.

The interesting commonality is that they are both targeting new mobility products (Mobility-as-a-Service) and fast growth. The question is to understand if they will converge and compete more directly on products and customers in the future.

Source : – http://bit.ly/39xH2J4