Imagine shopping for your next car insurance and the car company offers an insurance that connects a black box, dongle or a mobile phone app, which tracks how you drive, and saves you up to 30 percent on premiums. This, in essence, is the future of connected car insurance, also called usage-based car insurance (UBI), whereby based on how you drive, when you drive and where you drive, you will receive a competitive quote if you are what the technology deems a ‘safe driver.’

Usage-based car insurance started in the late 2000’s as a niche experimental effort by a select number of insurance companies in select regional markets. Fueled by an increase in the number of connected cars and smartphones, it has now become a mainstream offer by most insurance carriers especially across North America and Europe. Driving information can be accessed online or on apps allowing customers to monitor their driving patterns and make needed adjustments to improve their chances for better discounts. Today, big insurance names offer mileage-based, driving behavior-related discounts, and customers now have the option to choose an insurer before they walk out of a dealership with their new car.

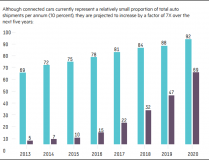

Pay as you drive (PAYD) and pay how you drive (PHYD) business models are likely to become the preferred types of metrics to calculate premiums. In addition, greater influence of data analytics will see options such as manage how you drive (MHYD), gain momentum beyond 2020. A recent Frost & Sullivan analysis suggests that there is an appetite for UBI policies and is expected to reach close to a 100 million drivers by 2020, dominated by Italy, UK (exceptional push from a safety angle for younger drivers) and the US.

With some smartphone apps that provide “try-before-you-buy” (TBYB) options, this is also seen as a “cool” product, which is predominately targeted at millennials, allowing them to find out how safe they are behind the wheel or what score they can obtain and share with followers on social media. Pay-per-ride or pay-per-use models can be expected to become increasingly significant as these “cool” millennials impose their preferences on the market.

In a recent interview I had with Jonathan Hewett, Industry Leader in the UBI Space, CMO for Octo Telematics, he stated, “Octo was born out of the dissatisfaction with one-size-fits-all approaches to insurance, which don’t reflect how we actually use our cars. We’ve seen rapid growth year on year in the uptake of telematics policies across Europe and the US, with Octo ending 2016 with more than 4.8 million global users. As the market evolves, we will see things like autonomous vehicles and car sharing become more mainstream, complicating both our roads and the way we insure our vehicles. Telematics data brings clarity and customization to our insurance policies.”

Jonathan also spoke about Octo’s portfolio play in terms of device technology ranging from mobile apps, black boxes and connected car technology, as well as the company’s new platform which will take data from any device to deliver insurance telematic services. The platform has the ability to retrieve data from 17 different sensors within the vehicle. By integrating data from these sensors and having a platform approach, combined with on-demand mobility solutions, they can provide 10 to 12 percent reduction in the total cost of ownership of fleet insurance due to crash detection, better claims management and efficiency in getting vehicles repaired and back on the road.

Companies like Octo will be key in the future due to their ability to provide insurance, as well as fleet and car sharing management needs, under one integrated platform for their customers. These insurance platforms will become increasingly important as we move towards a future of connected living. Insurance companies will be able to redesign policies where data from auto insurance will be an extension of home, health, life, and even pet insurance policies. Imagine a future where your driving behavior also influences your home insurance (good luck to the Italian and German road rage drivers).

The connected car insurance industry will also see huge competition from startups. Smartphone apps, quote comparison aggregators, and cloud exchange platform players who are leveraging “software as a service” models, are disrupting the insurance industry. TrueMotion, Mojio, Cuvva, for example, are some of the insurance mobile apps leveraging a complete digital experience using telematics data. Companies like Metromile, leverages a plug-in device along with a smartphone app, which provides vehicle health reports, location-based services and tips to help the user with their everyday commute.

In the future, we will see premium valuations of usage-based insurance companies and it won’t be a surprise to see more M&A activity in this sector. For instance, Insure The Box, a company that owns brands like drive like a girl(great catchy name) in the UK, sold a 75 percent stake (worth GB£105Mn) to a Japanese insurer, who interestingly is a kiretsu of Toyota. Such links go on to show how car companies with financial arms are showing interest to cover insurance in their fleet and leasing options and making it an interactive tool to create brand loyalty.

In closing, just like car companies got into insurance and leasing, they will all in the future adapt and sell User-based insurance solutions. So don’t be surprised if your insurer asks you to fit a black box in your car. You might be concerned about privacy, but for sure it will be cheaper if you are a safe driver who does not accelerate fast and brakes hard.

The following article was written in contribution from Frost & Sullivan Mobility Program Manager Niranjan Manohar.

This article is from a Frost & Sullivan 2017 Usage-based Insurance study in progress, and below are links to already existing research across this space:

- Executive Overview of the Usage-based Insurance Market in Europe and North America: http://frost.ly/1eb

- Strategic Update of the European Usage-based Insurance Market for Passenger and Commercial Vehicles: http://frost.ly/1ec

Author – Sarwant Singh

Courtesy of Forbes