Martin Kahl considers the role of the OEMs in the provision of mobility services, and talks to PSA and VW about breaking into a multi-billion dollar industry

US$8tr – that’s as much as the mobility services industry could be worth, according to top automotive OEM executives.

In a speech about the automotive industry of the future, the now retired Ford Motor Company Chief Executive, Mark Fields said in 2016 that the mobility services industry – which includes ride-sharing, ride-hailing, bike-sharing and taxis – could be worth US$5.4tr; more recently, Dr Ian Robertson, BMW Group Board Member for Sales and Marketing said it could be worth around US$3trn more.

That considerable additional revenue comes from all of the mobility activities transactions made far out of reach of the OEMs, despite involving the vehicles made by those same OEMs. How the traditional automotive industry – which Fields and Robertson have valued at around US$2trn – can benefit from this additional revenue really is the multi-trillion dollar question.

To be in with a chance of tapping into such riches requires a new way of thinking for the mainstream OEMs, which have been scrambling their resources to develop mobility services business strategies, often even involving the creation of dedicated sub-brands.

How this differs from just a few years ago is interesting. For a while, it appeared the OEMs were in danger of missing out on lucrative new downstream opportunities having given up, a decade or so earlier, on the idea of making money downstream; a succession of failed attempts at generating profit from vehicle servicing and car rental saw OEMs divest their downstream businesses as streamlining became the order of the day.

“We’re very mindful of the trends towards the shared economy. In the near future, we might find ourselves selling a suite of transportation services, in lieu of today’s traditional vehicle sale” – Mike Tinskey, Ford Motor Company

With OEMs concentrating on building and selling cars, the future of any other business seemed to lie in the hands of technology companies such as Apple, Amazon, Google and Uber. Were they to have been successful in controlling the mobility space, one could easily have imagined the OEMs – the companies once seen as the disruptors – being the disrupted, and ending up as mere contract manufacturers, building vehicles to specifications provided by those tech companies.

Downstream lies danger – and opportunity

Led in part by necessity, in part by ambitious and visionary C-suite executives, in part by a need to retake control, and in equal measure by a technical ability to do so facilitated by hitherto unachievable levels of connectivity, the vehicle manufacturers fought back. New business models began to take shape, ideas from elsewhere began to be mapped onto the automotive industry and the rise of the sharing economy appeared to mark the end of an era for an industry so reliant on brand loyalty, personalisation, customer conquest and customer retention. But how has this transformation come about? And how do they go from what they have today to something they can call a success?

New ideas, new sub-brands

The OEMs may appear to be back in the race, but to truly take control requires considerable strategic realignment. In its report, ‘Remodeling for mobility’, EY says OEMs need to rethink their strategy to succeed: ‘When starting from an incumbent position, automakers will not out-innovate disruptors unless they view their own legacy business as an enemy. They will succeed only by confronting their old modes of operating, overcoming inherent constraints and shaking up their businesses.’

VW unveiled Sedric, its self-driving pod concept, at the 2017 Geneva motor show

2016 saw a series of OEM sub-brands launched primarily to house not only innovative new powertrain technologies but also new mobility services and other left-field ideas not immediately natural to the traditional automotive industry.

At the 2016 Paris Motor Show, Daimler launched EQ, PSA Group launched Free2Move, and the Volkswagen Group announced a 13th brand, Moia, to operate as a mobility services brand. Geely has launched Caocao, a ride-hailing activity positioned upmarket with a B2C focus and a 6,000 strong fleet of so-called new energy vehicles (NEVs). The Renault-Nissan Alliance recently established a 300-strong start-up division to focus on core technologies for connected cars and new mobility services; it acquired French software company Sylpheo, signed a multi-year agreement with Microsoft and a research agreement with Transdev to explore the development of mobility services with fleets of autonomous EVs for public and on-demand transportation. And Toyota has launched Toyota Connected, a mobility services platform (MSPF) to house connected services, financial services and car-sharing. One of the first activities is a pilot programme with Getaround in San Francisco.

These sub-brands join GM (Maven), Ford (Smart Mobility) and BMW (i Mobility Services). There is an apparent opportunity for premium services, too, with GM launching BOOK by Cadillac and Lincoln announcing Lincoln Chauffeur.

PSA’s emov electric vehicle rental scheme in Barcelona has over 100,000 subscribers

‘Mobility 2.0’ places at its core the need to develop a relationship with the customer. It’s oft-repeated but always relevant: once a vehicle has been sold or leased, there is at best minimal contact between the OEM and the customer. The downstream services have much closer relationships with those same customers, through subscriptions and membership schemes. And those consumers are increasingly fickle, and decreasingly brand loyal. They pay for services as and when they require them, switch suppliers on a whim, and they do as much as possible online.

The folks’ wagon?

At the heart of mobility services, then, lies the consumer. But how is that different from what the automotive industry has been doing for 130 years?

“The difference lies in the new and large challenge which the digital era brings with it,” says Dr. Lars Heidenreich, Head of Smart Mobility in Volkswagen Group’s Digitalization division. “It’s not just the automobile that is being reinvented through the digital revolution. Mobility itself is being reinvented. For this we have reorganised our design department for the digital age. We’re setting up three new Volkswagen Group Future Centers in Europe, Asia and California, where design and digital experts create the vehicles of the future. Such a cross-functional melting pot of digitalisation and design, working hand-in-hand to create and implement the interior, exterior, and the user experience design and engineering of our products and services is groundbreaking in the automotive industry. The work will be integral, direct and with an absolute focus on our customers, their needs, wishes and dreams with design thinking and customer centricity.”

“It’s not just the automobile that is being reinvented through the digital revolution. Mobility itself is being reinvented” – Dr. Lars Heidenreich, Volkswagen Group

Volkswagen is developing a whole new way of thinking, says Heidenreich. “In order to manage the transition and digital transformation successfully, and to develop new business opportunities and market potential with mobility services, we will further develop to become an integrated hardware, software and services company. We aim to drive this transition and lead the way. That’s why we are increasing the development speed and the investments in these important innovations in the fields of digitalisation and autonomy, and we have created a new structure in our organisation for this. With this, the Volkswagen Group will further advance from being a vehicle manufacturer to becoming a leading provider of sustainable mobility.”

Significantly, Heidenreich sees the OEM’s task as exploiting its current position as a traditional vehicle manufacturer in order to benefit from new mobility. “30 years ago, the American computer scientist Alan Kay said: ‘People who are really serious about software should make their own hardware.’ We at Volkswagen Group agree and see things the exact same way. Our huge competitive advantage is that we’ve already perfected the hardware over many decades. We must, and we will, execute on the software and services development with the same focus and attention to detail as successfully done on the hardware development.”

One of the challenges facing the OEMs in this game is how to tailor mobility services by brand, when the vehicles will be used by many people effectively as commodities. Heidenreich believes that this will not be an issue – and he speaks as someone with 13 VW Group brands to contend with. As he sees it, autonomy and the future of mobility are intertwined.

Launched in December 2016, and operated as an independent company, Moia is VW Group’s 13th brand. Headed by Chief Executive Ole Harms, Moia has been tasked with becoming ‘one of the world’s leading mobility service providers by 2025’

“Automated driving will generate an entirely new form of expression. The more freely designers are able to develop vehicles, the better and more consistently they will be able to adapt vehicles to people’s individual lifestyles and personal wishes. We will not have uniform autonomous vehicles. On the contrary, the roads of the future will become even more varied, more colourful and more emotional. Over the coming years, individual Volkswagen Group brands will provide quite individual yet specific definitions and highlights for this new mobility. Just look at some of our recent concept cars, which demonstrate how different and brand-specific these multifaceted outcomes can be. The spectrum ranges from our SEDRIC self-driving car concept, to the various fully electric, zero-emission Porsche, Audi, Skoda and VW vehicles. These cars that can be accessed on demand will not just bring us closer to safe accident-free driving, but can also offer great driving pleasure, because emotion, performance and fun to drive will also be important factors in the future.”

Social services

Pursuing the self-driving car theme, Heidenreich outlines where autonomous driving fits into the mobility services picture. “In the new mobility world, we will offer accessibility for everyone. It can be used by adults and children alike. This individual mobility can also be used by people who do not have a driving licence or people who have previously not had access to individual mobility because of physical disabilities. Look at how little or no individual mobility we offer to the weakest amongst us – the elderly, the blind, the sick and our children. In the future, we will transport these people conveniently and without hassle from door to door. Such services will give users an enormous increase in quality of life.”

Heidenreich says he is convinced that autonomous driving will not be restricted to city conurbations. “Autonomous automobiles provide added value for mobility because they can be easily driven independently to the edge of the city where they can be parked and recharged. This avoids wasting valuable inner-city space for parking. Today, a large proportion of the time spent in a car is lost time. Think about traffic jams, stop-and-go in the city, or the wasted time searching for parking. We will give people this time back.”

“OEMs are strategically or haphazardly spending millions on technologies or buying companies. And it’s being done to hedge bets, because people aren’t really sure where it’s all going to settle” – Larry Dominique, PSA North America

The first of VW’s mobility service offerings will come through the Moia brand, which will launch with specifically-branded electric people carriers for ride-sharing, similar to Ford’s plans with Chariot, or Uber’s Uber Pool. The US launch is currently expected in 2018, with a target to become a top-three mobility company within a decade.

Without a car, you’re free to move

Unlike VW’s branded approach to mobility services, PSA’s Free2Move brand is based not on specific vehicles, but on services – and its approach is a cautious one. OEMs have struggled to define ‘mobility’, and several are taking the shotgun approach, says Larry Dominique, the former TrueCar executive and automotive industry veteran who heads up PSA North America. “They are either strategically or haphazardly investing everywhere, spending millions of euros and dollars on looking into technologies or buying companies. And it’s being done to hedge bets, because people aren’t really sure where it’s all going to settle.”

As a European company looking to make a new mark on the US market, PSA Group will need to adapt its strategy to a very different mobility culture, with US cities having little passion for public transportation. “In the United States, we have 260 million cars on the road. We sell 17.5 million cars a year. But we also sell 42 million used cars a year,” notes Dominique. “The average commute in the United States varies, but many people are in their cars 30 or 40 minutes a day commuting. Sometimes that means you are commuting 40 or 60 kilometres to get to work. And the reality is, that’s not driving – that’s commuting.”

An interesting point about this new notion of mobility is the rush not only to launch mobility services, but also to define those services within brands. This is a clear recognition that mobility is much bigger than just selling cars – it’s about being with your customers every step of the way, every part of their day, including bicycles and other means of last mile transportation.

Dominique concurs. “People are starting to live in an Amazon world. They’re used to one-click purchases, they’re used to not having to wait. Transportation and mobility have to tie in to that don’t-want-to-wait mentality we’re seeing globally.” This means offering apps that identify the closest ride-share or ride-hail vehicle.

“That’s the key to the future. And the beauty of it is that those ancillary businesses, those other verticals that we can tap into – data and connectivity – are high margin businesses. If you can diversify your core business, namely auto making, by offering these ancillary services to consumers, you have the opportunity to supplement your P&L with innovation and high margin opportunities.”

PSA – the post-manufacturing OEM?

PSA’s ‘Push to Pass’ strategy details the eventual marketing of PSA Group cars in North America. Ironically, for the moment, PSA in North America is playing the part of a post-vehicle manufacturing OEM, offering car-based services in a market where it does not even sell cars. “We have a greenfield opportunity in North America,” acknowledges Dominique. “We have the ability to approach a marketplace where every other OEM has years of legacy from dealer networks, brand establishment and market share. We have the opportunity to think about the post-modern world of the automaker and define it. We don’t have to take an existing model and try to rearrange it or redefine it.”

Free2Move joins PSA’s new-look suite of brands, which now includes Opel and Vauxhall, which the OEM recently acquired from GM. “That gives us a scale that we didn’t have before. It’s a very positive thing” – Larry Dominique, PSA North America

PSA Group has already begun to enjoy mobility service success; it recently announced 100,000 subscribers to its Emov electric vehicle rental scheme in Barcelona. But how will this translate into success elsewhere? “Our goal under Free2Move is to take best practices and learn about the evolving mobility from wherever it is in the world and see if there’s a global opportunity for that execution. What we’re doing in Europe, we’re looking to adopt here. Some of the things we might be doing uniquely here, we may adopt in Europe. Our goal is to really understand the market as we roll out mobility. It’s all about data and understanding the consumer and the usage. The more we know about the consumers and their behaviour, what they want and don’t want, and what they like and don’t like, the better the offer we can make them when we start providing automobiles directly to them.”

A timetable for when that will happen, which types of vehicles, and which brands, has not yet been published. Recent developments have, however, added to PSA’s brand offering – it has acquired the European operations of General Motors, giving it a German and a British brand, namely Opel and Vauxhall. “That gives us a scale that we didn’t have before. It’s a very positive thing,” notes Dominique.

The most exciting period in the auto industry’s history

“If automakers set up new business units to compete in the new mobility industry … they must design new operating models for these units,” writes EY in its aforementioned ‘Remodeling for mobility’ report. “Leveraging relevant capabilities from the core business must not come at the expense of remaining tied to the old ways of operating. This doesn’t mean abandoning the core business – adept organizations will create feedback mechanisms for the new units to transfer knowledge and process innovation back to the core for continuous improvement.”

“Over the coming years, individual Volkswagen Group brands will provide quite individual yet specific definitions and highlights for this new mobility. Our recent concept cars demonstrate how different and brand-specific these multifaceted outcomes can be” – Dr. Lars Heidenreich, Volkswagen Group

PSA’s Dominique and VW’s Heidenreich have echoed that; and speaking at SMMT Connected, an event organised by the UK’s automotive industry lobby group in London in April 2017, BMW’s Ian Robertson said, “This industry is 100 years old. We have done what we do in the roughly the same way for 100 years. We have designed in the same way, we manufacture in roughly the same way and our customers use the products in a similar way. In the next five to seven years, that will change more than in the last 100. We’re at the tipping point of the most exciting period in this industry’s history. We are moving in the direction of being tech companies, and the tech company part is the most exciting phase of the last 100 years.”

It’s a view shared by Ford. Mike Tinskey, the OEM’s Director of Connected Vehicle – Emerging Services, told Megatrends, “As a company, we’re very mindful of the trends towards the shared economy and connectivity. We believe these trends are real, and with them will come new and emerging business models. In the near future, we might find ourselves selling a suite of transportation services, in lieu of today’s traditional vehicle sale.”

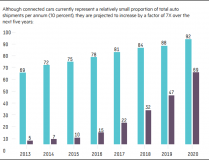

According to Frost & Sullivan, the number of people using app-enabled car-pooling services already stands at 40 million worldwide, with 70 million using ride-hailing apps. The consultancy attributes the success to the ability to integrate and aggregate mobility services, enabling customers to plan, book and pay for journeys on smartphones. These services are so lucrative that Frost & Sullivan estimates the revenue potential of such digital mobility services reaching around US$2tr by 2025 globally.

From being providers of mobility and servicing, the OEMs are transitioning into mobility services providers. There’s a long way to go before they get the model right, and even further before it’s commercially viable, but work done now will lay the foundations not just for success, but for survival.

This article appeared in the Q2 2017 issue of Automotive Megatrends Magazine. Follow this link to download the full issue

Courtesy of Automotive World