Insurers and auto manufacturers are using technology to meet growing consumer expectations, and this will have a major impact on the auto insurance market.

The U.S. automotive insurance market will face numerous challenges in 2017 and beyond.

As the auto industry responds to changing vehicle technology and notions of personal mobility, and the growth of digital technologies, the internet of things (IoT), artificial intelligence (AI) and analytics, the type of insurance products carriers will underwrite and the way claims are resolved will also change.

As the industry meets the demands of an increasingly digital customer base, they must also simultaneously address rapidly changing consumer expectations and ever-more complex and sophisticated vehicles. Automakers have responded to government regulation on fuel economy, emissions reductions, safety and other factors, and new products and technologies have been developed, leading to a much more technologically advanced vehicle fleet.

Better safety increases claims costs

To improve vehicle crash worthiness and occupant safety, automakers have designed vehicles with more energy transfer built into the vehicle design. They are also using stronger materials in the front structure and in the upper and lower rails to reduce crush in the occupant compartment. This can often create additional challenges when identifying where the energy from a crash traveled through a vehicle, and where that vehicle might be damaged. As a result, repairers are finding it necessary to complete a pre-repair 3-D measure while blueprinting the vehicle.

Additionally, the numerous features being added to vehicles that focus on convenience, fuel efficiency, and safety are driving rapid adoption of microprocessors, sensors, infrared imaging, cameras, radar and other technologies in vehicles. Many of these parts are mounted in areas of the car that tend to be damaged often — even in minor accidents — including bumpers, fenders, quarter panels, grills, mirrors, and lamps. Each of these are essentially brand new components on a vehicle (typically with no non-OEM alternative) that have the potential to be damaged or misaligned during a vehicle accident, resulting in new labor and parts costs that didn’t previously exist.

And, because many of these advanced electronics and driver assist systems don’t provide a visual indication that there is a system malfunction or diagnostic trouble code (DTC), additional labor time to conduct both a pre-repair and post-repair scan to identify what was damaged and ensure it was fixed might also be necessary. While changes to vehicle construction and the incorporation of crash avoidance technologies lead to fewer injuries and fatalities, there can also be an increase in the time and cost to repair the vehicle.

As the pace of change among vehicles has ramped up, collision repairers have had to respond by getting training, tooling, equipment and certification to deal with a growing number of complex material types such as aluminum and carbon fiber, as well as increasing electronic complexity. It has become even more critical for insurers and repairers to consider damage information, metallurgy, OEM position statements and model-specific procedures from the manufacturer, particularly with structural repairs. Unfortunately, as vehicle complexity has risen, so have automotive claim costs, and insurers will increasingly face pressure to do what they can to manage that increase.

Safety redesigned

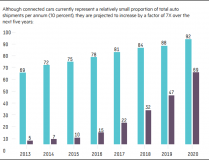

In 2003, 47 percent of all repairable vehicle appraisals were for vehicles ages zero to three years of age (MY 2000 to MY 2003). When vehicle sales fell sharply during the recession, the vehicle fleet aged, but a seven-year streak of strong new vehicle sales has led to growth among the newest vehicles again.

In 2016, 40 percent of all repairable vehicle appraisals were for vehicles ages zero to three years of age, but now these are MY 2013 to MY 2016 that are much more complex. For example, standard options offered on the base MY 2015 Ford F-150 pickup include items like side-impact air bags, head curtain air bags, stability control, and traction control — none of which were standard on the MY 2000 or earlier versions. A comparison of vehicle repair costs by vehicle age and how those costs have grown over the last five years point to further increases in repair costs in the coming years (see Figure 1).

All of these changes in vehicle design (such as the introduction of more complex lighting technology in headlamps) as well as changes in material types among various body panels have led to higher cost parts for the industry. For example, the percent of replaced lamps that are LED or Xenon has grown each year over the last 10-plus years (see Figure 2.1).

In 2016, the average cost of a Xenon/LED lamp was 56 percent higher ($527) than non-Xenon/LED lamps ($338) (Fig. 2.2). While the cost difference has shrunk over the years, it has more to do with the increasing complexity of all lamps.

Growth in electronic vehicle content — items added to address vehicle safety or convenience (none of which were needed previously for the vehicle to simply operate in the past; i.e., getting from point A to point B) are also adding to the overall cost of repair. With more than 80 percent of the cost of the vehicle repair from labor and replacement parts, the industry is experiencing further increases in both.

As the data in Figure 3 illustrates, labor needed for part replacement, calibration, reset and scan, as well as the cost of additional parts can add hundreds of dollars in additional fees. The next several years are going to be challenging, as automakers compete to position themselves for the changing world of personal mobility, introducing increasingly more technology that will be expensive to repair, but may not immediately deliver on all of its promises in terms of accident prevention.

Author – Susanna Gotsch (sgotsch@cccis.com) is director, industry analyst at CCC Information Services Inc. She has been with CCC since July of 1992 and brings more than 20 years of experience within the automotive claims industry.

Courtesy of PropertyCasualty360.com