A differentiated approach across key demographics, including income and age, can help OEM automotive players service and retain customers, as well as boosting aftersales, providing a competitive edge.

The light vehicle aftermarket – where spare parts, accessories and components for motor vehicles are traded – is one of the key areas in which Original Equipment Manufacturers (OEM) automotive supplies are able to improve their profit margins. In the truck industry for instance, gross margins are between 35-50% on aftersales activities.

A new study from BearingPoint, has revealed particularly millennials are increasingly open to using independent workshops for maintenance and repairs. OEMs are meanwhile finding themselves at risk of losing their key advantage, access to diagnostic data.

Respondents were asked to identify key factors that influenced their preference for authorised workshops over independents. One area with relatively high levels of correlation is the income level of customers, for instance, 51% of those with incomes of more than €3,000 per month use authorised workshops compared to 44% of those with incomes of less than €3,000 per month. The difference is even starker for higher and lower income brackets, with 60% who are paid more than €10,000 a month using authorised workshops and 47% of those on less than €2,000 a month using independents.

Another area of correlation is the age of the respective customers. Older customers, those 55+, tend to prefer using authorised workshops, while millennials (26-35) tend to use independent workshops. Car age too played a role, with the research finding that newer cars, those <5 years old, tend (57%) to go to authorised workshops while those >5 years tended to go to independent workshops (56%).

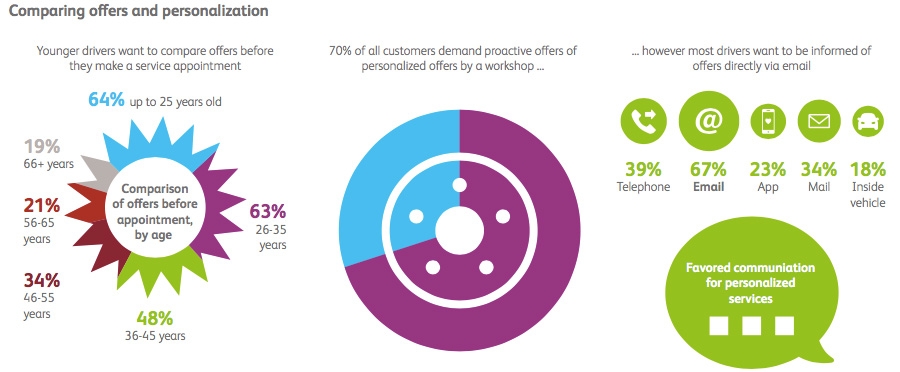

The consulting firm‘s researchers also found that one of the initial events that challenges owners in the wider aftermarket journey is being informed of the vehicle needing a service. The prompt, whether through mileage or onboard software, results in a large number of customers (39%) moving to compare offers from various workshops. Young people in particular shop around, with 64% of those up to 25, 63% of those between 26-35 and 48% of those between 36-44.

Given the risk of losing a customer in the first part of the wider journey, the firm notes that OEMs offering customers tailored products and services allows them to improve conversions – with email (67%) the preferred route for offer, followed by a call (39%).

The research also found almost three quarters of the respondents (71%) prefer an upfront estimate of costs before they make a booking for a service at a workshop. Both OEMs and independents are therefore more likely to attract a customer with a clear and full breakdown of service duration, price and costs. Access to diagnostic data from a connected car is able to give OEMs an advantage, as they have more insight into the likely needs of the customer in relation to which parts have suffered the most wear and tear, they can, in addition, be prepared for the service with the right parts in stock – reducing the service turnaround time.

The customers surveyed have stronger expectations for a pleasant atmosphere at authorised workshops than at independents, and meeting that expectation is one of the wider key drivers for converting and retaining customers. In addition, customers expect authorised dealers to offer digitally supported services, have a customer advisor that knows them personally as well as the car and its history.

Customers in general also noted that they were well received in a pleasant atmosphere, with many too stating that the advisor know the customer and their car. The area found to be most lacking is digital support and service. The authors also sought to identify what factors are the most important to respondents from different countries. In the UK for instance, customers are keen on a good experience and proximity to a workshop, while in Germany customers are sensitive to proximity and price.

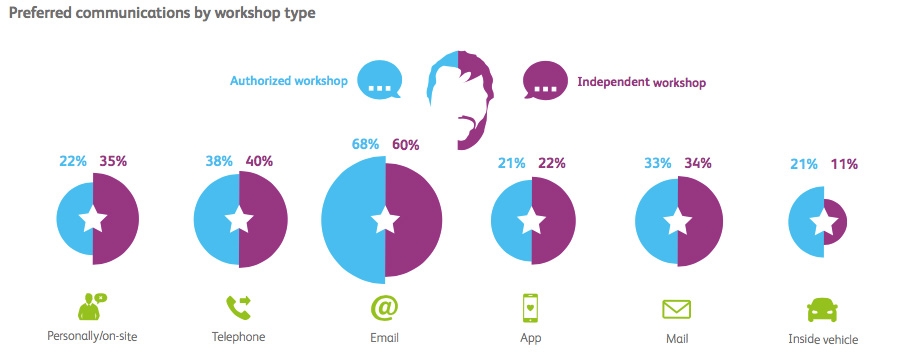

Following a service or repair, a follow up engagement in which a customer can provide feedback was found to improve retention. 51% of respondents said that they would prefer to give feedback. The younger generation tend to be more keen on receiving emails, while the preference for telephone contact increases considerably by age, with 55% of those below 25 keen on a call, as opposed to a huge 90% of customers aged 66 and over. The research notes that there is little difference in the preferred communication method between authorised workshops and independent workshops.

Courtesy of Consultancy.uk